News Summary

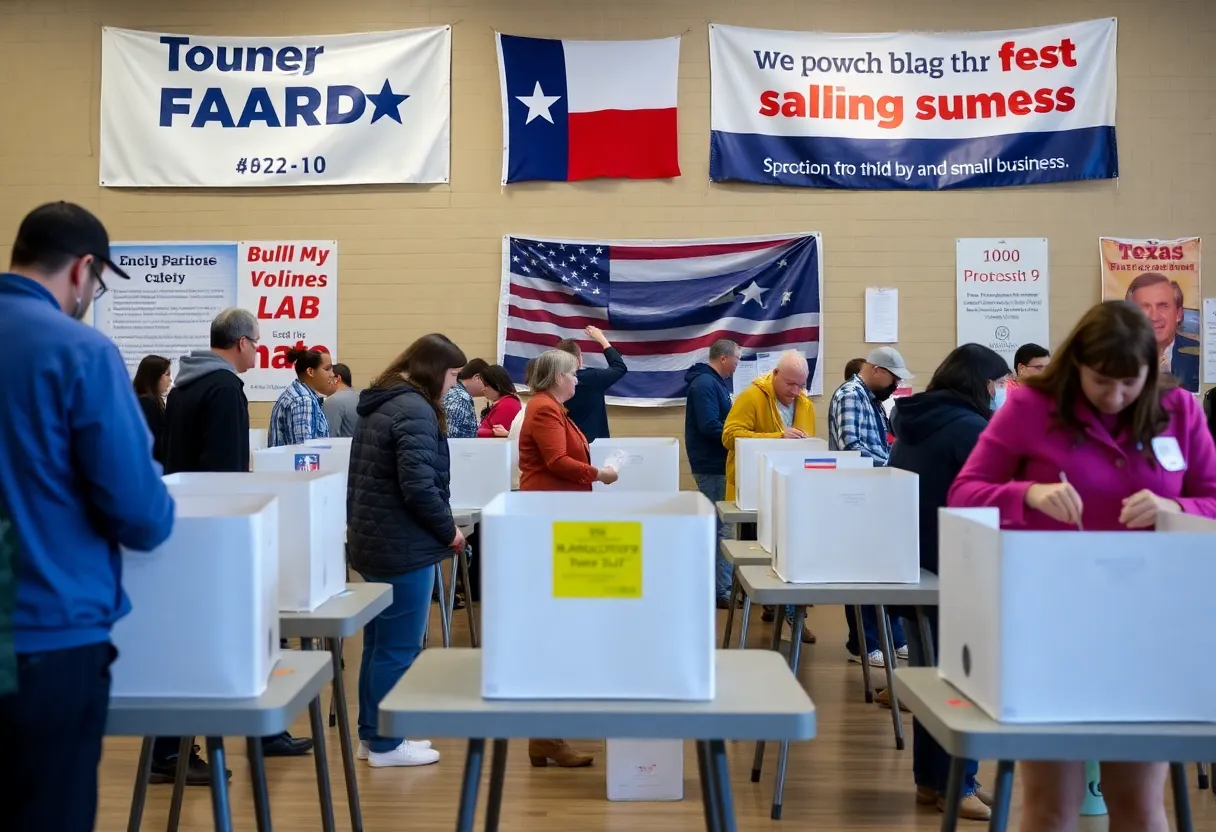

Texas has kicked off early voting as voters prepare to cast their ballots for multiple propositions, with particular attention on Proposition 9. This measure aims to significantly raise the inventory tax exemption for small businesses, offering potential financial relief and encouraging economic growth. With the election date approaching, voters are urged to stay informed about the implications of this and other proposals on the ballot, which could reshape property tax obligations for many residents and businesses across the state.

Texas is set to kick off early voting on Monday, October 20, 2025, for the upcoming Proposition 9, which aims to provide crucial tax relief for small businesses. The early voting period will run until Friday, October 31, 2025, with Election Day scheduled for November 4, 2025. This proposition is part of a broader movement to address property tax concerns across the state, with 17 total propositions slated for consideration by voters.

Proposition 9 seeks to significantly increase the inventory tax exemption—known as the business personal property tax exemption—from $2,500 to $125,000. This change is being heavily endorsed by various business advocates, including the National Federation of Independent Business (NFIB), which emphasizes the importance of this relief for small business owners. The inventory tax is a pressing issue, as it requires businesses to pay taxes on all owned items, effectively taxing them on their entire stock, which can hinder operational growth and community investment.

Business leaders argue that reducing the inventory tax burden is essential for the survival and growth of small businesses within Texas. The NFIB highlights that the passage of Proposition 9 could save Texas small businesses more than $500 million annually, allowing them to reinvest in their workforce and local communities. By alleviating this financial pressure, supporters believe small businesses can enhance their competitive edge against neighboring regions, which already benefit from lower tax burdens.

In a related commentary, small business owner Bud Walters of Texas expressed the financial strain of the current inventory tax system, citing his annual tax payment of over $40,000. Walters indicated that less money going to taxes could free up resources for business expansion.

In addition to Proposition 9, the ballot will feature other important propositions, particularly regarding property tax changes. Proposition 13 proposes increasing the homestead exemption from $100,000 to $140,000, while Proposition 11 aims to raise the homestead exemption for seniors and disabled residents to $200,000. These changes are part of ongoing efforts by state legislators to provide vital property tax relief to Texans.

Furthermore, additional propositions outline potential property tax reductions for the surviving spouses of veterans and those whose homes have suffered damage due to fires. These measures reflect a continued commitment by state officials to improve the financial situation for Texas residents, especially in challenging economic times.

As early voting approaches, the NFIB has launched a new Voting Hub aimed at assisting voters with election reminders and providing information on polling locations. This initiative is part of a concerted effort to encourage participation in the election and ensure that important propositions, like Prop 9, receive the necessary support from constituents.

With early voting on the horizon, it is increasingly critical for voters to engage with these propositions and consider the potential impacts on their local economies and individual financial burdens. The upcoming vote on Proposition 9, along with other significant propositions, could reshape the landscape for small businesses in Texas and provide essential tax relief for many residents.

In conclusion, as Texas gears up for early voting, the emphasis on Proposition 9 represents a vital opportunity for voters to support small businesses while contributing to the broader mission of tax reform within the state. Engaging in this election process will play a crucial role in shaping the future of small business operations and property tax policies in Texas.

Deeper Dive: News & Info About This Topic

- NFIB: Vote Yes on Prop 9

- Houston Chronicle: Texas Constitutional Amendments

- Houston Chronicle: November Voter Guide

- Community Impact: Wilco ESD No. 9 Sales Tax Increase

- Encyclopedia Britannica: Property Tax

Author: STAFF HERE COLLEGE WRITER

The COLLEGE STATION STAFF WRITER represents the experienced team at HERECollegeStation.com, your go-to source for actionable local news and information in College Station, Brazos County, and beyond. Specializing in "news you can use," we cover essential topics like product reviews for personal and business needs, local business directories, politics, real estate trends, neighborhood insights, and state news affecting the area—with deep expertise drawn from years of dedicated reporting and strong community input, including local press releases and business updates. We deliver top reporting on high-value events such as the Brazos Valley Fair & Rodeo, Chilifest, and Aggie Muster. Our coverage extends to key organizations like the Bryan-College Station Chamber of Commerce and United Way of the Brazos Valley, plus leading businesses in education, biotechnology, and retail that power the local economy such as Texas A&M University, Fujifilm Diosynth Biotechnologies, and H-E-B. As part of the broader HERE network, including HEREAustinTX.com, HEREDallas.com, HEREHouston.com, and HERESanAntonio.com, we provide comprehensive, credible insights into Texas's dynamic landscape.